Q2 2024 Investment Thesis in AI: Focus on Asset-Light Infrastructure & Enabler Solutions.

Author: Andy Nurumov

April 2024 | San Francisco, US

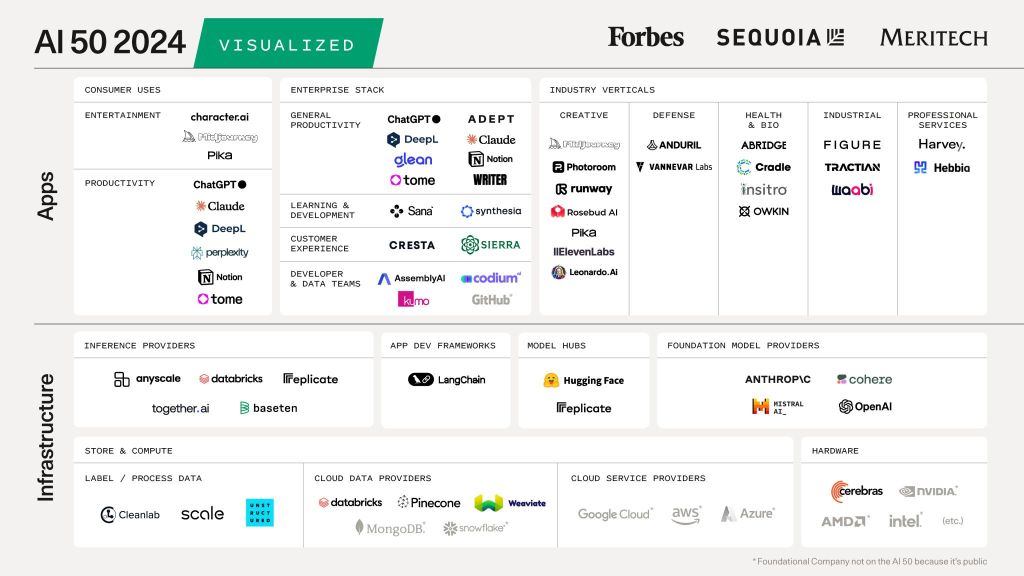

Forbes and Sequoia Capital recently published a list of the top 50 AI companies. If you are new to the AI space, it is a good starting point to understand the current AI landscape. However, keep in mind that the landscape could be completely transformed in the next 3-5 years or even by 2025.

Different stakeholders could execute concrete strategies leveraging the AI trend. Let’s talk about these strategies for Corporations, Investors, and Startups.

A. First, general points in the landscape:

Playing in “Apps” is hard long-term now – there are almost no sustainable business models. What is more important is that your product-market fit in these startups could be temporary. Moreover, after 6 months on average, you need to release a new model to remain competitive.

Additionally, during the “hype” period, many people will still be focusing on the Apps side, and for the Infrastructure side, it creates a continuous source of cash flow. Therefore, all parts of the ecosystem will support this hype wave for a long period of time: one – to attract clients, another – to attract cash flow from the first group. Moreover, keep in mind that many enterprises are in an AI experimentation mood. They could spend several percent of their revenue on experimentation, including AI, as long as the hype exists.

B. Current incumbent (tech) corporations should play asset-light.

For current tech incumbent enterprises, it is better to “play” in the Infrastructure part of the landscape, but keep in mind that the cash generation in these parts of businesses could decrease – similarly to the cash flow of the COVID vaccine business for Pfizer. Talking about the Apps side, only invest a substantial amount if data suggests that the solution directly disrupts your business; otherwise, it is a good time to wait.

C. Investors should focus on long recurring cash flow and the business case for clients.

From some AI investors, you could hear “we focus now more on founders and less on business models or what the product does”. This is at least a “yellow” flag for me if I were an LP. Having “great talent” is not enough; they have to work with the right vision on the right problem. Moreover, many investors are not tech-savvy; therefore, it is better for such profiles of investors to play in the infrastructure part, where business models are clearer. Moreover, be ready for downside scenarios, particularly in the Apps dimension. For instance, some investors invested in companies with billion-plus dollar valuations, the LLM models of which already almost underperform some new open source solutions.

In terms of metrics – except for basic ones, I would focus on 1+ year client retention as one of the criteria for success. Considering the hype around AI, many can have engagement, but in the current environment, there is a “lot of noise” in engagement metrics.

Valuations: Companies could decrease in valuations from peaks. As a case in point, Pfizer, with a significant core business prior to the pandemic, went down more than 50% from its 2022 peak price in just 1 year. Be cautious with large multiples – growth and, as a result, multiples could become lower later on when you will exit.

D. Startups should not recreate a “wheel”.

Well-known investors in the space have the concrete landscape in mind when they invest, and your venture should have a clear place in this landscape. Do not focus only on the technology part (which is a large problem for many AI startups), but also on the business part to make your business more financially sustainable and to reinforce your competitive advantage over time. If you want success in AI with a higher probability, read the parts for Corporations and Investors as you should be interesting for them.

E. Final thought.

Long-term, you could be bullish in AI as the preconditions to transform the services part of any economy are clear. But there will be many losers and winners along the way during the next two decades. Be adaptable as an investor – your investment thesis in the AI space could be modified almost every year.

Thank you for reading. Hope you enjoyed. Stay tuned to read the following articles later on.

Copyright: Citation and paraphrasing usage are welcome with a hyperlink to the original article.

About the author: Andy Nurumov specializes in Enterprise Tech, AI, and Marketplaces. He is a Founder and ex-CEO of an 8-figure B2B E-Commerce marketplace for Enterprise clients, which he scaled to a team of 20+ people and positive cash flow.

TOPICS

#AI #Sequoia #Forbes

sources

Forbes, Sequoia