Building and Investing in Q3 2024: “Where all think alike, no one thinks very much.”

Author: Andy Nurumov

July 2024 | San Francisco, US

“These 2000 pages will be your most significant investment in your business creativity.”

If you are pondering about the investment thesis for your new fund or building something new, this post is for you. Your scope can go beyond a few topics typically discussed by the media and investment community.

I conducted a similar exercise 6 years ago when I created the investment thesis for a Fortune 1000 corporation. I recommend undertaking this activity at least once in your lifetime if your work involves change.

Finally, such reading gives you an edge in answering the question, “Why now?”.

Go Wider, then Deeper.

There are new macro and business trends driving demand for your products and services. New successful businesses and extraordinary returns in existing businesses will come from executing strategies that rely on these trends.

On the attached trend map from Forbes (Figure 1: Megatrends), there are 12 major streams of these trends and around 100 topics, in total, to keep in mind. While many similar trend maps exist on the Internet, none are complete, but you can choose one among them to start with and then create your own trend map.

Figure 1: Megatrends

For each of these 12 streams on the map, there are usually around 100 pages of high-quality content published by banks, think tanks, and the research community (I recommend minimizing the number of consulting reports). After reading them, choose 2-3 streams, and around 10 topics in them in total, and delve deeply into them, reading about 100+ pages per topic.

I won’t comment on any specific topics, as each one has the potential to thrive: NLP (Natural Language Processing), B2B Marketplaces, or the Rise of Tier-2 cities.

These ~2000 pages in total will be your most significant investment in your business creativity.

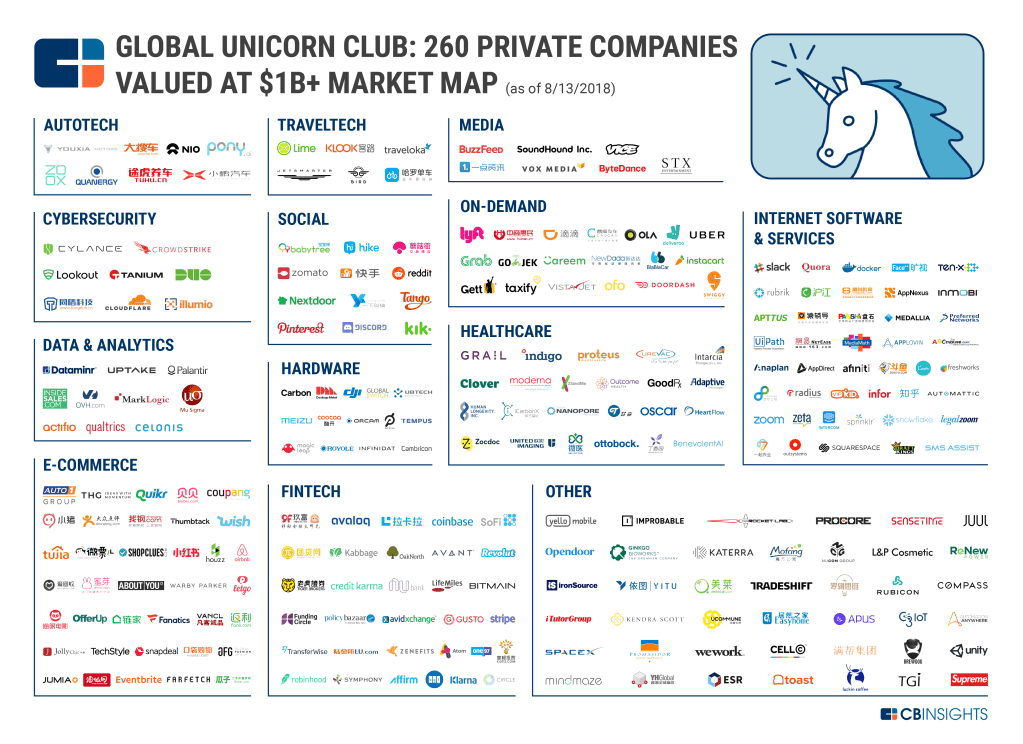

The rest of the summer could be enough to cover this task. The earlier you start, the better, as the amount of information does not increase linearly for such exercise. For instance, back in 2018, there were only around 250 private unicorns; now, the number is around 1,250— 5x increase in less than a decade.

At the same time, for me it is interesting to compare how this trend map has changed over the last 6 years. And I am eager to see the next changes in next 6 years, i.e., in 2030, and take advantage of the current ones. Stay tuned!

P.S. Do not apply such thematic investing for Hedge Funds or Public Markets thematic funds. This method usually does not generate above-market returns. However, there may be room to apply “stock picking” based on these trends. In the last 5-6 years, top performers such as Nvidia, AMD, Tesla, Eli Lilly & Co, Blackstone, KKR, and Ares Management are examples from topics of the similar maps from 2018. See more about the best-performing stocks on NASDAQ.

P.P.S. VC Nostalgia

Figure 2: Unicorn map from 2018

Copyright: Citation and paraphrasing usage are welcome with a hyperlink to the original article.

About the author: Andy Nurumov specializes in Enterprise Tech, AI, and Marketplaces. He is a Founder and ex-CEO of an 8-figure B2B E-Commerce marketplace for Enterprise clients, which he scaled to a team of 20+ people and positive cash flow.

TOPICS

#Megatrends #AI #Creativity

sources

Forbes, CB Insights, Nasdaq